Following the announcement by Toyota and Suzuki that they intend to strengthen their burgeoning alliance by taking small stakes in each other, David Leggett, automotive editor at GlobalData, a data and analytics company, offers his view.

“Industrial pressures and the need to control costs – especially in developing expensive advanced technologies – are driving automotive companies to consider collaborating. Selective collaborations between companies are a relatively low-risk and manageable way to achieve synergistic benefits without the political turmoil that can come with proposed mergers and acquisitions.

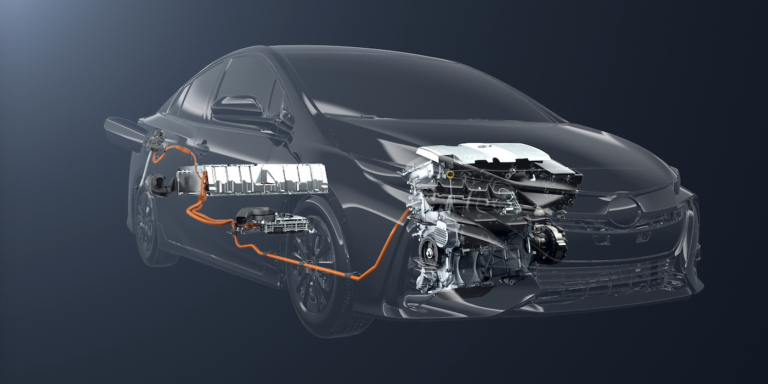

“The industrial and competitive backdrop is compelling. Automotive companies have to invest huge sums in developing new technologies such as electrified powertrains, automated driving systems and connected services.

“In this case, Suzuki lacks the size and resources to go it alone, but in working with Toyota it can benefit from Toyota’s strength and scale in electrification technologies. Toyota gets the benefit of Suzuki’s strong presence in compact vehicle segments and technologies; it is also market leader in India, a key emerging market for the 2020s.

“The two companies have already announced the cross-supply of selected vehicles, technologies and powertrains in Europe and India to lower costs and raise capacity utilisation at manufacturing plants. They are moving forward with their alliance.

“The shareholding announcement serves to cement the deepening relationship between the two companies.”

Toyota plans to acquire 24,000,000 shares of common stock in Suzuki (4.94% ownership of the total number of shares issued by Suzuki as of March 31, 2019, excluding treasury shares, with a total value of JPY 96 billion) by underwriting the disposition of treasury shares by way of third-party allotment conducted by Suzuki. Likewise, Suzuki plans to acquire, through purchase in the market, shares in Toyota equivalent to JPY 48 billion.