Global automotive semiconductor revenue for 2020 is forecast to exceed initial expectations, primarily due to an increase in the average semiconductor value per car sold this year, according to new analysis.

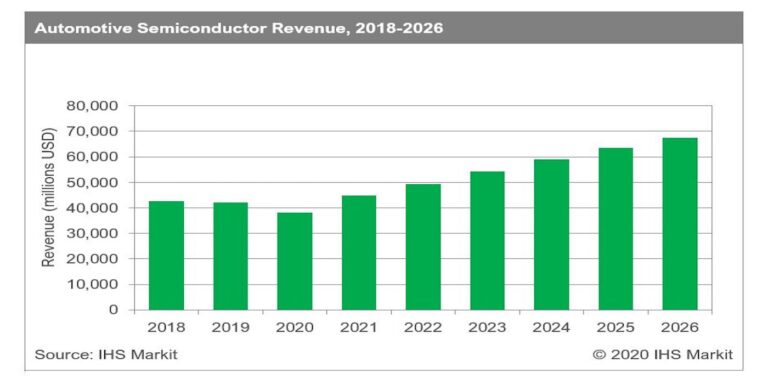

IHS Markit now expects semiconductor revenue to contract in 2020 by -9.6% to just over US$38 billion, which contrasts to the mid-year view where semiconductor revenues were expected to drop 20% by year end compared to 2019. IHS Markit continues to anticipate robust growth in 2021, reflecting improved demand and production conditions and especially a further uptake in electric vehicles, one factor which has helped to boost the semiconductor market in 2020.

Two factors are driving the recovery, notably low automotive inventory that will result in new car growth next year, combined with stimulus packages designed to benefit the ailing car sector while favouring the switch to electric and hybrid cars, which are typically more expensive than equivalent internal combustion-driven models.

Both hybrid and electric vehicles have significantly more expensive power semiconductor content required to control components such as traction motor inverters and DC-DC converters, but the electrification trend also supports autonomy features and advanced infotainment, even in the smaller car segment.

One of the impacts of COVID-19 is that it has led to an increase in the average semiconductor value per car sold. In some parts of Europe, for instance, the government is only providing incentives for electrified vehicles. This differs from the “cash for clunkers” type of initiative employed in certain regions following the 2009 financial crisis, designed to get older vehicles off the road. In many cases this favoured sales of smaller vehicles, equipped with less electronics. Additionally, today’s hybrid- and electric vehicles are also fitted with more autonomy-related features and more advanced infotainment and HMI systems, even in the lower cost segments.

The shift in propulsion type in part created by the pandemic is not a momentary burst, and higher levels of electrification will continue to propel the market for semiconductors well past 2021 – itself a year expected to see a market-corrective expansion of 18% over 2020. By 2026, IHS Markit forecasts the global market for automotive semiconductors to reach US$67.6 billion, a healthy compound annual growth rate of 7% from 2019 to 2026.